Insights and Observations from an OT guy who went into IT

The “Market”

I think it’s best to start a long look back on the Internet of Things (IoT) by establishing some guard rails. First let’s establish that IoT is not a single market in the traditional sense. Rather it is a market trend that is made up of several smaller markets.

Therein lies the first challenge with assessing anything IoT related…what the heck is it! It means different things to different people and there is very little standardization in how it’s approached. If you know that going into it you will be able to devote more focus, early on, to defining your effort in the IoT space.

In my career I’ve led a new solutions assessment process at least 6 times in the IoT space. This space in the IT industry is very exciting and where most start ups typically play. It involves Total Addressable Market (TAM) analysis, competitive, channels, technical architecture, systems interop, integration, partners, engineering and more. The first key to success in each of these endeavors was to drop the IoT designation (at least amongst the working teams). I quickly replaced the designation with a more descriptive, clear description.

Focusing on the sub-markets or market segments within the many areas of IoT is a necessary first step if you want to be successful in this space. For example, in launching IoT at Cisco I choose a single use case to focus on; energy. I knew that in assessing the many areas where Cisco could play in the IoT space that energy made the most sense. From there I directed the acquisition of building mediation, active energy management (IP-based) and smart grid technologies. Each of these techs addressed different segments of the global energy market and all within an IoT lens given that global energy providers have not adopted IP-based techs broadly.

Questions and Insights

If yes; then it is likely a SW play only as the majority of HW on the Edge can provide General Processing Unit (GPU) capabilities. Obvious exception here is if you build HW and think you can build a better option than the many already out there.

If no; then this market is largely untapped today if you provide IT solutions. The best example of this perhaps is the global utility market. This market has a low adoption rate for contemporary IT solutions

If yes; serving this market will require less cost up front to build your brand

If no; its more costly but potentially higher returns if you’re first of early to market

If clearly no; don’t waste your time. No amount of technology will solve organizational and/or human problems

If yes or maybe; if a clear yes then you are really on to something. There is a lot of tension operationally between IT and Operational Technologies (OT) teams. If maybe; consider a “market testing” model where you trial your solution incrementally with a small market sampling.

Observations

First, IT companies who are hungry to innovate and willing to take the associated risks, end up driving the entire industry forward. This industry is unique in its ability to radically transform how other industries do their thing. In that regard, the IoT market is simply where the IT industry intersects and has an impact on the OT industry.

Second, the OT industry will likely never be the primary driver for IoT innovation. On the contrary, the OT industry, in-line with their priorities will be the necessarily tough customers the IT industry needs to ensure their tech’s are operationally ready.

Finally, in assessing the market potential coming from the OT side of the business it is important to consider they will work in tandem with their internal IT teams. This is key nuance to consider in your market assessment. I think it is best considered in assessing how your solution can operationally “unify” the internal IT and OT teams who will ultimately be the decision makers for your offer. If it doesn’t bring them together and keep them together on driving an improvement then you have a problem.

Most Common Mistakes

I’ve broken this section out from two points of view; the vendor and the end user. I’ve been on both sides and can provide a perspective on both. Many of the challenges on both sides share similar roots by are experienced very differently.

By Vendors

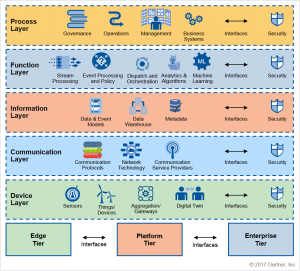

The IOT Hype Cycle has reached critical mass. To the point where navigating vendor options is so difficult that Gartner developed an IoT reference model, in part, to serve as tool between users and vendors to help mitigate the pain. Paul DeBeasi shares the basic framework here.

While I’ve been lucky enough to work with companies that have been successful in the IoT space, I know many colleagues and former employees who have not. I bet you probably do too. There are very few who’ve tried to “solution” in the IoT space that don’t have some scars to show from it.

Related to our fist section on trying to get ones hands around the IoT market; the most common mistakes typically start with a poorly defined scope/definition. Many vendors over the last 10 years have been driven to develop an answer on IoT simply due to the glut of marketing out there. Where is the specific customer demand? What is the specific problem(s) you are solving? How does your new IoT solution add value to the existing core product portfolio? These are all questions that either don’t get answered or are answered by a small group of “IoT Experts” within a strategic marketing function.

The second most common mistake I see is not understanding the ecosystem(s) that an IoT offer impacts on the user side. Many vendors take a very narrow slice of a big IoT solution framework and market their slice as the whole pie. This creates cascading confusion across the many user teams and leads to poor customer sat once it comes time for a proof of concept. It also impacts your employee moral and retention as it the front line sales teams that get blasted and loose their commissions.

The last area I see vendors struggling is at the executive level. This is perhaps a larger statement than just the IoT market but who is actually innovating anymore? There are very few if any large, mature IT vendors that deliver net new, innovative products that are developed in house. Acquisition has become the new innovation strategy of convenience for many institutions with a long pedigrees of innovation. A failure to innovate against a known set of challenges is, to me our biggest failure of all as an IT industry. Remember the goal here is to improve how the OT industry works, plays and learns.

By Users

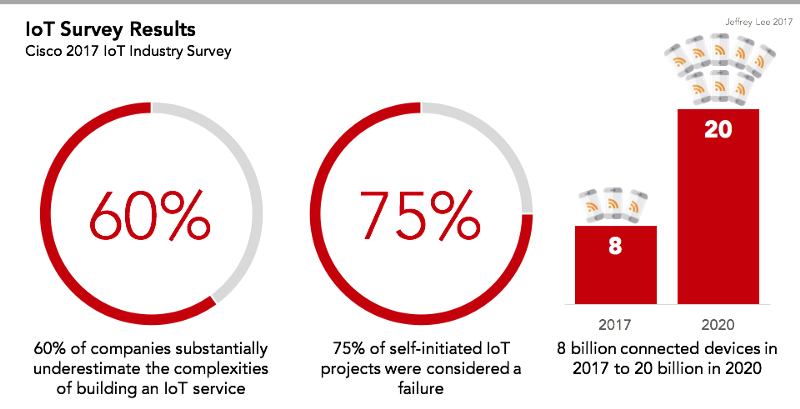

From a users perspective I’m keeping observations confined to what strategies I’ve seen cause problems. Without a doubt, the largest mistake I see users make is to underestimate the scope and scale of an IoT (aka Edge) project. I see this error at all levels in the organization but usually starting in the C-suite. It then cascades throughout the org and leads to missed expectations, long deployment/testing cycles and ultimately an unsuccessful project.

Related to same issue on the vendor side, users often don’t have a clear enough definition for what they want to do with an IoT project. This is not completely unique to the IoT space. Users often don’t have a clear definition of what they want from a CRM system either but that market is mature enough to show the way. The IoT space is far younger and carries far more options for where you can go with it. Further complicating things is that there usually isn’t enough standardization at the network level in most companies to quickly and effectively deploy a large IoT project.

The final error I will highlight is fairly technical but its where many architects have major issues. This last point also ties back to our first point in this section that focuses on a common mistake at the executive level. One best practice this often overlooked is to think back to old frameworks like ITIL, TOGAF and others build an IoT reference model. Reference models are highly useful in ensuring a project can be assessed architecturally across multiple technical domains. Architects with deep expertise in a single technology domain often struggle with this important step. Without having a pictorial representation of current and future state architectures, it will be difficult at best to keep the many technical and business teams aligned to the sales decisions, goals and metrics.

The Technology

The crazy thing about tech in the IoT space is that it’s all already here. At least the pieces are. In fact, the first major wave of IoT innovation has already come and gone. Cisco led the way (with a little help from me) from 2009-2013 and only stopped its major marketing push once the combined IoT BU’s hit the $1B run rate. Since then the product line has gotten so big that Cisco is going back to the basics that served it well in 2009, recently launching Cisco Edge Intelligence. This product is almost identical to the Edge product we released over 10 years ago. So, a long way to say there isn’t much limiting the IoT space that is purely technical in nature.

Like many industries before it, IoT is following a boom, bust, build out phase…albeit highly abbreviated as compared to others. The IT space does this over and over. Many even run in parallel like right now with Cloud, IoT and containerization all going through their own respective transformation cycles. The same rigor and discipline is assessing Cloud can be applied to IoT for example. The key differences often relating to scale and complexity.

The current need is less about acquiring the data and storing what you need at the edge. That was largely addressed in the first dev cycle. This is why you see so many General Processing Unit (GPU) devices deployed today. Today, users need a modular way to deploy tech’s that don’t disrupt the rest of the business, integrate with their operations and have a clear business benefit over time.

There are a number of vendors trying to build intuitive asset, video, data and data center management tools. Some of these are having limited success in “digitizing” older industries and operations like manufacturing, resource extraction and utilities. However, these offers don’t scale across the enterprise. Rather they are limited to a single operation and usually for highly specialized operations. There is yet to be a Tivoli or OpenView like market lead in the IoT space.

Perhaps the largest, big picture reason I see for the lack of a real lead in this space comes down to operational priorities between IT and OT. Now bear with me as there is some connective tissue here. Technology development typically happens on the vendor side of the house. Within the development shops of the OT and IT world there is a massive rift in understanding the customers across each industry. The OT guys often see the IT guys a science experiment, nerd types and the IT guys often see the OT guys as antiquated, paranoid operators who are afraid to innovate. Obviously neither are correct but that is often what I’ve seen across countless intersections between the 2 groups. So, this translates into the 2 development groups to not even consider what the opportunities might be to bring the 2 groups closer together.